Would it be as easy to understand the price of a candy shop as paying for some candies? Unfortunately, a candy shop does not come with a price tag and the shop, unlike the pack of candies, has unseen enterprise value, such as revenue, profits, debts, assets, and liabilities attached to it. You need to calculate these measures, among others, to have a fair understanding of the market value of the shop. Valuation of a small or medium enterprise can be complex, but it is one of the critical skills that founders and investors need to develop. Accurate valuation is a crucial shield for investors, buyers, and sellers to make well-informed decisions regarding the company’s investment, acquisition, or sale. Knowing how to value a company is vital to consistent entrepreneurial success.

What is company Valuation?

Company valuation is the process of determining the economic value of a business. It involves evaluating and calculating a company’s overall worth by considering various factors such as its assets, revenue, market position, growth potential and expected future cash flows. Different theoretical methods will help you get close to an approximate number.

Finding our Accounting & Bookkeeping content interesting?

world-class services.

THE FIRST CONSULTATION IS FREE!

How to value a company?

Valuing a company involves assessing its worth based on various factors. Common methods include analysing financial statements, considering market conditions, and using comparable company analysis. The choice of method depends on various factors: industry, the company’s life cycle, and the purpose of the valuation (e.g., sale, investment) among others.

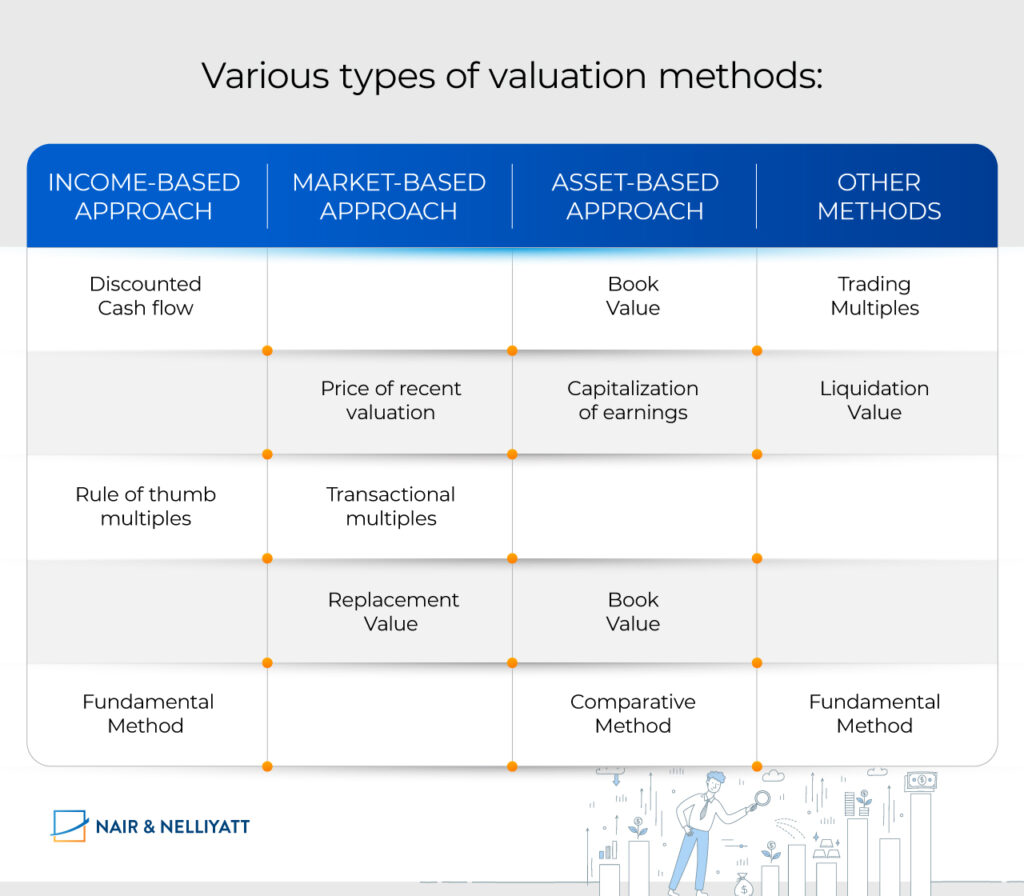

Types of Valuation Methods

The best types of valuation methods:

It is necessary to remember that valuation methods should be chosen based on the financial metrics and the qualitative consideration of future cash flow and risks. Now, the valuation of a company can be done using any of the above traditional or modern methods depending on the market, the industry, and the company’s age. Here, we explain a few of the most common techniques used for enterprise valuation.

1. Income-Based Approach

The income-based approach is a method used in business valuation to determine the enterprise value of a company based on its income-generating capabilities. This approach considers the present value of expected future earnings and cash flows. There are several methods within the income approach, and the most common one is the discounted cash flow method.

The Discounted Cash Flow (DCF) method

This is a widely used valuation technique. It involves estimating the future cash flows a company is expected to generate and then discounting them back to their present value. This method enables the comparison of cash flows that occur at different times by adjusting them to the same point in time. The method’s complexity is tasking, yet it is one of the most common methods of evaluating a company.

Advantage of the Discounted cash flow method: Emphasis on Internal value

The DCH method puts forth the closest estimate of the company’s intrinsic value. The method focuses primarily on the internal aspects of the company and never on external comparisons. The DCF model is also helpful in valuing the potential combined benefits in a merger or acquisition (M&A) deal. It helps estimate the additional enterprise value created when two companies combine their operations.

Disadvantage of the discounted cash flow method:

The method is highly theoretical. Predicting free cash flows for the next one or two years, let alone five years down the line, is quite challenging. Small changes in growth rates, spending, and profit margins can significantly impact cash flow predictions and, as a result, a company’s actual value. To deal with these uncertainties, analysts usually create a personalized DCF model. They then conduct a sensitivity analysis to provide a range of valuations considering different discount and growth rates.

2. Market-Based Approach

Comparative analysis, specifically Comparable Company Analysis (CCA), is another way we value a company for SMEs. This technique uses valuation multiples from publicly traded companies to estimate the value of a privately owned business in the same industry. It’s important to mention that these multiples from public companies don’t consider control premiums, which are usually factored into M&A deals. Sometimes, adjustments may be necessary to reflect the larger size of public companies.

This method sheds light on the firm’s competitive standing within its industry, providing a benchmark for its valuation. This comparative approach involves analyzing comparable companies or transactions to derive a valuation for the target company in question. This process gives a preliminary estimate of the company’s enterprise value based on the market’s perception of similar businesses.

Advantage of the Market-Based Approach: Accessibility of Information

Various reports, including mandatory filings overseen by regulatory authorities such as the Securities and Commodities Authority (SCA) in the UAE, offer substantial information regarding publicly traded companies in the region. These filings are crucial for business owners to compile data on revenue and EBITDA multiples and enable a thorough comparison between the valuations of publicly listed companies and a potential valuation for a privately owned business in the UAE. The analysis of historical data, encompassing growth, profit margins, and other metrics, serves as a reference point for business owners to assess and measure their company’s performance.

Disadvantage of Market Based approach: Comparison vs comparison

While this method offers valuable insights, it might not capture all unique aspects of the target company. A young start-up or small company cannot be compared to a market leader. No two companies are the same in any given industry.

This comparative analysis might only partially reflect factors like growth potential, proprietary technology, or a niche market presence. Hence, while the market-based approach provides a vital reference point, it is often used with other valuation methods to arrive at a more comprehensive and accurate estimate of a company’s worth.

The asset-based approach

Want to learn more about how to value a company based on assets? The asset-based method simply determines how much a company is worth by looking at its balance sheet. This approach focuses on determining ownership interest concerning valuation. Unlike the income and market approaches that concentrate on a company’s income or cash flow, the asset-based approach looks at the company’s balance sheet.

When determining the enterprise value of a small business, one of the initial steps is to clearly define the ownership stake in the business being assessed for its value. This means specifying, “what” the valuation is supposed to determine:

Is it:

1. The total assets of the company,

2. The total long-term interest-bearing debt and total owners’ equity,

3. The total owners’ equity, or

4. One particular class of owners’ equity.

Knowing the company’s total invested value/capital (TIC) is crucial, especially for an asset acquisition. TIC includes the value of all long-term debt plus all classes of owners’ equity. Understanding the TIC value is helpful in acquisition scenarios where the acquiring company will take on both the equity and debt of the target. In an asset-based approach, the value of a target company equals Total Assets minus Total Liabilities.

Advantage of Asset-based approach: Clarity in Asset Value

The asset-based approach provides a clear picture of the company’s value based on its tangible assets, which can benefit industries where asset value is a significant factor.

The disadvantage of using Asset-based approach: Excludes Intangible Assets

This approach may not account for the value of intangible assets, such as brand reputation or intellectual property, which could be essential components to understand how to value a company.

Let’s explore the concepts of discounted cash flow (DCF), the market-based approach, and the asset-based approach through a typical example through a hypothetical retail company named “TechMart” operating in the UAE.

| INCOME-BASED APPROACH (Discounted Cash Flow) | MARKET-BASED APPROACH | ASSET-BASED APPROACH |

|---|---|---|

| TechMart analysts forecast the company's future cash flows by considering its expected sales, expenses, and investments. Let's assume the company is expected to generate cash flows of $5 million annually for the next ten years. To find the present value of these cash flows, analysts apply a discount rate (say 10%) that reflects the time value of money and the risk associated with these future cash flows. By discounting each year's cash flow back to its present value and summing them, the DCF method arrives at an estimated value for TechMart. | Analysts identify other retail companies in the UAE with similar size, growth prospects, and market presence. Let's assume there are two comparable retail firms, "GadgetXYZ" and "ElectroABC," which recently underwent acquisitions. GadgetXYZ was acquired at 12 times its EBITDA, while ElectroABC was received at eight times its EBITDA. If TechMart's EBITDA is $3 million, applying an average multiple of 10 times EBITDA from these transactions, the market-based approach estimates TechMart's value at around $30 million. | The asset-based approach determines a company's value by considering its balance sheet and the value of its assets. For TechMart, analysts assess its total assets and liabilities. Suppose TechMart's balance sheet shows total assets worth $25 million and total liabilities of $10 million. Using the asset-based approach, the estimated value for TechMart would be its Total Assets minus Total Liabilities, resulting in a value of $15 million. |

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a financial metric used to evaluate a company’s operating performance by excluding certain expenses to provide a clearer picture of its profitability. EBITDA is calculated by starting with a company’s earnings, typically net income, and then adding back interest, taxes, depreciation, and amortization.

As investors, analysts, and financial professionals, you use this metric to assess a company’s core operating performance, independent of financing decisions, tax environments, or accounting methods. It serves as a tool to compare the profitability of different companies since it eliminates non-operating or non-cash expenses. However, while EBITDA helps analyse a company’s operational efficiency, it must provide a complete picture of its financial health. You usually use it with other financial measures for a more comprehensive evaluation.

Factors Affecting Company Valuation:

The Significance of Qualitative Factors

While financial methods provide a structured approach, qualitative factors hold significant weight in the valuation process. As seen in a small tourism agency in Ras Al Khaimah, a well-established brand, extensive customer network, and strong market positioning elevate its value despite modest financial figures.

The Role of Economic Factors

Economic indicators in the UAE, such as oil prices, global trade, and government policies, influence company valuations substantially. Consider an e-commerce start-up in Ajman: Favorable government initiatives supporting the digital economy might significantly enhance its valuation. Economic factors can be drastic and unpredictable, dramatically modifying the company’s worth.

Market Trends and Technological Influences

The UAE market is versatile. It is constantly evolving due to technological advancements and market trends. The emergence of innovative tech solutions, consumer behaviour shifts, and e-commerce advancements significantly impact SME company valuations. For instance, a start-up offering AI-driven services in Sharjah might witness a surge in valuation due to the market’s speed-rocketing demand for AI services.

Impact of Global Markets and International Relations

As a global economic hub, the UAE’s SME valuations are not isolated from global markets and international relations. Fluctuations in global markets and shifts in international relations impact SME valuations in the UAE. For instance, a small trading company in Sharjah might experience valuation fluctuations due to changes in international trade policies affecting their import-export business.

The Art of Valuation Beyond Numbers

When finding solutions to how to value a company, it is important to note that each method assumes various market risks and will also assume the result of such risks. Models and numbers are assumptions, and they are uncertain. Valuing SMEs in the UAE extends beyond financial metrics. While numerical analyses provide a solid foundation. A significant aspect of uncontrollable circumstances—the market dynamics, cultural influences, technological advancements, and economic trends—is crucial in comprehending a company’s value. Moreover, the social impact, sustainability efforts, and corporate governance practices contribute to a company’s holistic valuation.

Conclusion:

Valuing a company may not be easy, but it’s crucial. With numerous traditional and modern methods available, selecting the most suitable one for buying, investing, or selling is essential. The choice of method can vary across industries, but seeking guidance from experts is advisable. With its professional expertise, Nair and Nelliyatt can assist you in making informed decisions that align closely with your goals, ensuring maximum benefit.