KYC is the basic step for regulatory compliance. Especially in AML, it helps assess and manage the risk of financial crimes on a large scale. KYC (Know Your Customer) and AML (Anti-Money Laundering) are crucial for preventing financial crimes. KYC and Re-KYC processes continuously safeguard your clients and business by ensuring accurate and up-to-date customer information.

What is KYC?

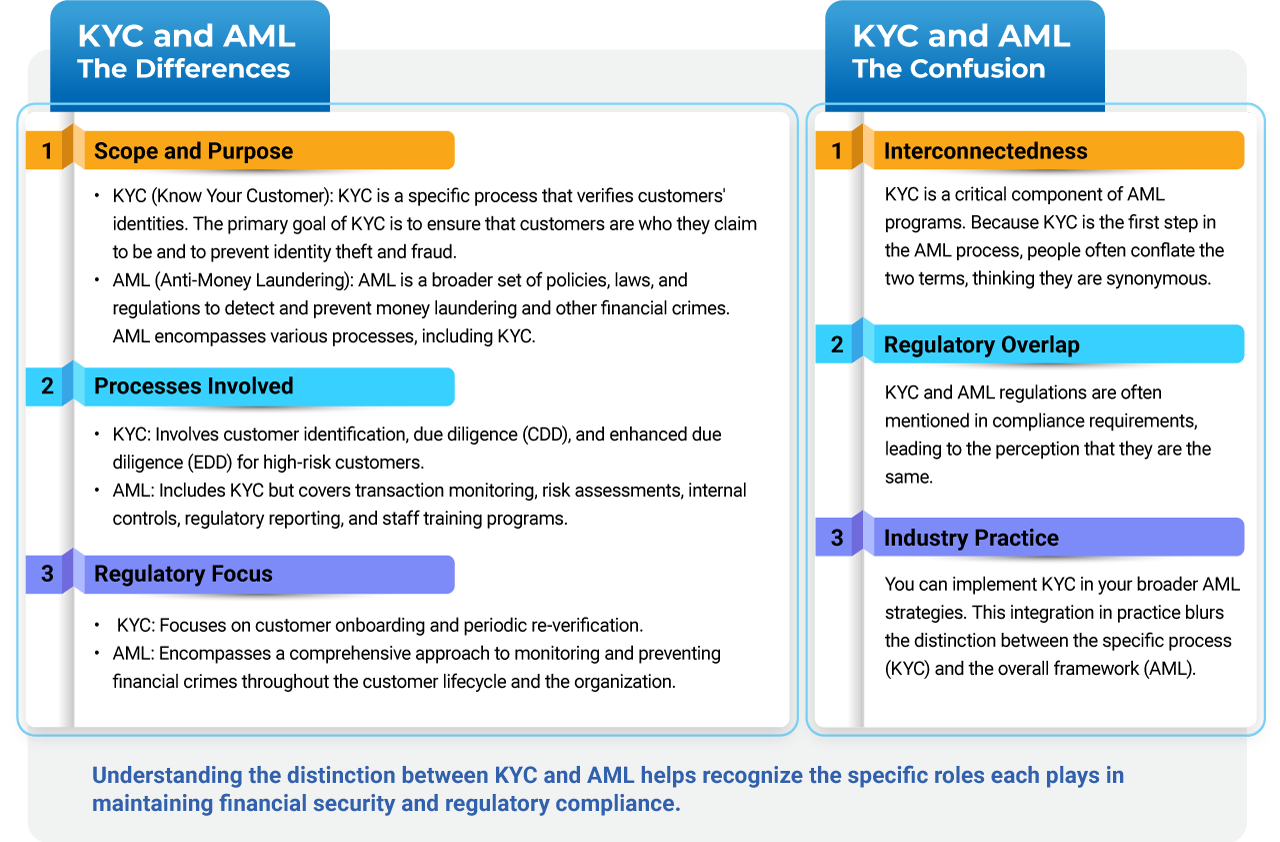

KYC, or Know Your Customer, is a critical process used by financial institutions to verify clients’ identities. It is a procedure to collect and confirm personal information such as name, address, and identification numbers. KYC helps banks and other financial entities assess the risk associated with each customer, ensuring they are not involved in illegal activities like money laundering or fraud.

What is Re-KYC?

Finding our Anti-Money Laundering content interesting?

Reach out to us for any queries or to avail our world-class services.

THE FIRST CONSULTATION IS FREE!

Re-KYC, or Re-Know Your Customer, is a process for periodically updating your customer’s information. Re-KYC ensures that all customer data remains accurate and current, helping identify and mitigate risks associated with money laundering and terrorist financing. Re KYC for high risk customer, Re KYC for medium risk customers, Re KYC for low risk customers are the categories that are normally used to establish regulations.

What is AML?

AML, or Anti-Money Laundering, are laws, regulations, and procedures used to detect, prevent, and report money laundering activities. The dangerous nature of money laundering is to disguise the origins of illegally obtained money as legitimate. AML measures disclose such aspects of ML.

To know how we can help you with AML Service

Why is Re-KYC Important?

1. Enhanced Security: Regular updates help promptly identify suspicious activities.

2. Regulatory Compliance: Staying compliant with regulatory requirements avoids penalties.

3. Risk Management: It helps categorize customers based on risk levels and takes appropriate measures.

Re-KYC for High-Risk Customers in the UAE

High-risk customers are more likely to be vulnerable to financial crimes. Financial institutions must conduct Re-KYC for high-risk customers more frequently, involving thorough background checks and continuous monitoring. Examples of high-risk customers in UAE businesses include international money transfer services and high-value investment firms. DNFBPs are most vulnerable and considered high risk customers, here is a blog that will help you understand more about DNFBPs .

Key Steps in Re-KYC for High-Risk Customers:

– Frequent data updates and verification.

– Enhanced due diligence and scrutiny.

– Regular monitoring of transactions.

Re-KYC for Medium-Risk Customers in the UAE

Medium-risk customers pose a moderate risk. For businesses in the UAE, such as mid-sized trading companies or retail banking clients, the frequency and intensity of Re-KYC for medium-risk customers are balanced accordingly.

Key Steps in Re-KYC for Medium-Risk Customers:

– Periodic updates of customer information.

– Moderate level of due diligence.

– Regular but less frequent monitoring of transactions.

How Often Should Re-KYC Be Conducted?

The frequency of Re-KYC depends on the risk category of the customer:

– High-Risk Customers: Every 6-12 months.

– Medium-Risk Customers: Every 12-24 months.

– Low-Risk Customers: Every 24-36 months.

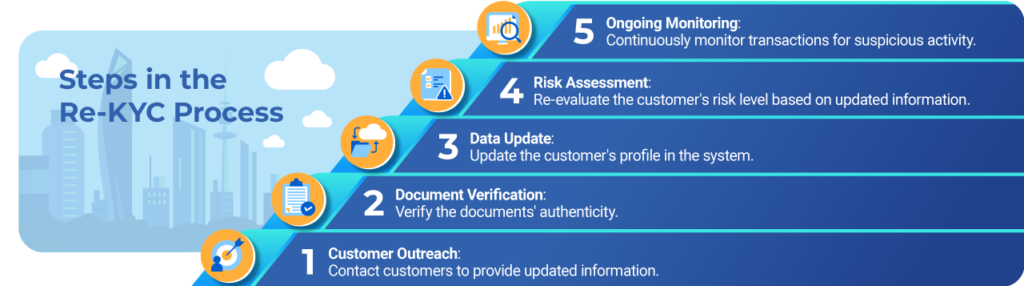

Steps in the Re-KYC Process

1. Customer Outreach: Contact customers to provide updated information.

2. Document Verification: Verify the documents’ authenticity.

3. Data Update: Update the customer’s profile in the system.

4. Risk Assessment: Re-evaluate the customer’s risk level based on updated information.

5. Ongoing Monitoring: Continuously monitor transactions for suspicious activity.

The Role of Technology in Re-KYC

Some of the critical assistance with technology in Re-KYC includes:

– Automating the verification process.

– Identifying patterns and anomalies in customer behaviour.

– Ensuring compliance with regulatory requirements efficiently.

Technologies Used by Financial Institutions for KYC and Re-KYC in AML Compliance

Financial institutions can leverage various technologies to streamline KYC and Re-KYC processes, ensuring robust AML compliance. Here are some critical technologies used:

1. Artificial Intelligence (AI) and Machine Learning (ML)

– Automation: AI and ML automate customer identity verification and detect suspicious transaction patterns.

– Risk Scoring: ML algorithms analyze customer behaviour and adjust risk scores based on real-time data.

2. Blockchain Technology

– Immutable Records: Blockchain ensures the protection of customer information and is immutable, enhancing the integrity of KYC data.

– Shared Ledger: Multiple financial institutions can access a shared ledger, reducing duplication of KYC efforts and speeding up the verification process.

3. Biometric Verification

– Facial Recognition: Facial recognition technology is used to verify customer identities during onboarding and re-verification.

– Fingerprint Scanning: Fingerprint technology provides an additional layer of security for identity verification.

4. Optical Character Recognition (OCR)

– Document Verification: OCR technology extracts and verifies information from documents like passports, IDs, and utility bills, speeding up the KYC process.

5. RegTech Solutions

Compliance Management: Specialized regulatory technology solutions help manage compliance workflows, track regulatory changes, and ensure adherence to AML laws.

– Transaction Monitoring: Advanced RegTech tools monitor transactions in real-time to detect and report suspicious activities.

6. Electronic Identity Verification (eIDV)

– Digital Onboarding: eIDV solutions allow customers to verify their identities online, reducing the need for physical document submission.

– Global Coverage: These solutions provide access to global identity databases, ensuring comprehensive verification for international customers.

7. Big Data Analytics

– Customer Insights: Big data analytics processes vast amounts of data to provide deep insights into customer behaviour and risk profiles.

– Anomaly Detection: Identifies unusual patterns and flags potentially fraudulent activities.

8. Application Programming Interfaces (APIs)

– Seamless Integration: APIs enable seamless integration of KYC/AML tools with existing banking systems.

– Real-Time Updates: APIs provide real-time updates and verifications, ensuring customer information is always current.

9. Cloud Computing

– Scalability: Cloud-based solutions offer scalability to handle large volumes of data and transactions.

– Accessibility: Provides remote access to KYC/AML tools, facilitating global operations and collaboration.

Integrating these advanced technologies enhances the efficiency and effectiveness of KYC and Re-KYC processes, ensuring financial institutions comply with AML regulations. By leveraging AI, blockchain, biometrics, and other cutting-edge solutions, financial institutions can better safeguard against economic crimes and maintain the financial system’s integrity.

Conclusion

Understanding and implementing the Re-KYC process is crucial for AML compliance. By regularly updating customer information, you can better manage risks and ensure the security of your operations. More frequent and rigorous checks are necessary for high-risk customers, while medium-risk customers require a balanced approach.

For an expert and customized understanding of KYC and AML for your business and how Re-KYC fits into the larger compliance framework, Nair and Nelliyatt offers expert guidance and advanced solutions. We are here to counsel and help. Contact us at info@nn-ca.com