Bookkeeping is as essential to a business as breathing is to the body. It’s the company’s lifeline, so tracking every penny that flows in and out is vital.

Misclassifying capital expenditures (CapEx) and revenue expenditures (RevEx) in bookkeeping will be expensive.

Capital and revenue expenditures are critical for maintaining and growing a business. They serve different purposes and uniquely impact financial statements. Misclassifying these expenses can lead to distorted financial reports, potential tax complications, and reduced profitability.

What is Revenue and Capital Expenditure?

The only common element is that they both are expenses. However, how you understand and record them will impact your bookkeeping dearly.

How do you account for capital expenditure and revenue expenditure?

Capital Expenditure:

Recorded as an asset on the balance sheet and depreciated over its useful life. Depreciation helps spread out the asset’s cost over multiple years, aligning with the asset’s lifespan.

Revenue Expenditure:

They are recorded directly on the income statement as incurred, reducing the reported profit for that period.

Expenses incurred yearly are often tax-deductible in that year.

Accurate classification between these two is critical because each impacts the business’s net profit, asset value, and tax obligations differently.

Finding our Accounting & Bookkeeping content interesting?

world-class services.

THE FIRST CONSULTATION IS FREE!

Example of Capital Expenditure vs Revenue Expenditure

Capital Expenditure

- Purchasing a new office building,

- Buying machinery for production,

- Developing software is expected to last several years.

Revenue Expenditure Examples

- Paying monthly Rent,

- Routine maintenance of equipment,

- Employee wages

- Office supplies.

Incorrectly classifying these expenditures can lead to inaccurate financial records.

For instance, categorizing a machinery purchase (CapEx) as a revenue expense inflates expenses and reduces net income for the year. Conversely, recording monthly maintenance costs as Capital Expenditure results in overstated asset values and inaccurate depreciation.

Is Depreciation a Capital Expenditure?

Depreciation ensures that expenses related to long-term assets are gradually recognised, aligning costs with revenue generated by the asset. This allocation provides a clearer financial picture of a company’s profitability and asset use over time.

To learn more about capital expense depreciation, explore – uae depreciation rates

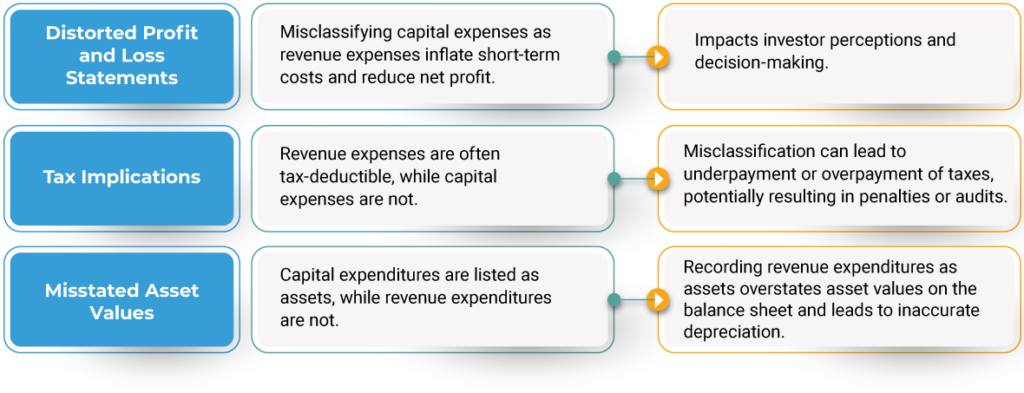

Misclassification Issues in Capital and Revenue Expenditure

Misclassification between capital and revenue expenditure is common, particularly in industries with complex assets or frequent operational expenses. The following are some of the vulnerabilities:

A construction company in Dubai purchases a new crane—a significant investment intended to last a decade. The company’s accountant, unsure of classification, mistakenly lists the crane as a revenue expense instead of a capital expenditure. This error impacts the company’s financial reports, showing a reduced profit due to the crane’s entire cost recorded as an expense in one year. When the company applies for a loan to expand operations, the bank questions its profitability, delaying approval. With expert help from NNCA, they later reclassify the expense correctly, enhancing their credibility and avoiding further financial mishaps.

Learn about the Benefits of Outsourcing Accounting to avoid these common financial pitfalls.

Industries Most Affected by Misclassification

Specific industries in the UAE frequently face challenges with the misclassification of capital and revenue expenditures due to the nature of their assets and operations:

Construction Industry: This sector requires frequent asset purchases and maintenance, such as heavy machinery and equipment. Misclassification is common when deciding between long-term infrastructure and day-to-day repairs.

Manufacturing Industry: Manufacturing businesses invest in machinery and factory upkeep, where differentiating between upgrades (CapEx) and routine maintenance (RevEx) can become complex.

Retail Industry: Retailers often invest in store improvements or technology upgrades, which should be classified as capital expenditures, while regular inventory purchases and store upkeep are revenue expenses.

Accurate classification is vital in these industries to ensure proper asset valuation and compliance with the UAE’s accounting and tax standards.

Comparison of Capital Expenditure and Revenue Expenditure

| Particulars | Capital Expenditure | Revenue Expenditure |

|---|---|---|

| Purpose | Enhances productivity, increases revenue, or expands the business | Supports day-to-day business operations |

| Time Horizon | Provides long-term benefits | Offers benefits typically within the current financial year |

| Accounting Treatment | Recorded as 'assets' on the company's balance sheet | Listed as 'expenses' on the income statement |

| Impact on Financial Statements | Adds to asset value, introduces depreciation expense, impacting profits | Lowers profits directly; doesn’t affect asset value |

| Frequency | Occurs occasionally, not a regular expense | Repeated regularly throughout the financial year |

| Examples | Buying machinery, acquiring land, or upgrading equipment | Rent, utilities, salaries, and marketing or distribution costs |

Why NNCA for Accounting and Bookkeeping?

NNCA specialises in helping businesses classify their expenditures accurately, offering expertise in capital and revenue expenditure classifications to avoid misstatements that can impact profitability and tax liabilities.

1. Expert Guidance: NNCA’s experienced accountants help businesses differentiate between capital and revenue expenditures, ensuring accurate financial records.

2. Compliance Assurance: NNCA protects your business from misclassification risks, penalties, and audit issues by ensuring compliance with UAE accounting regulations.

3. Empathic Solutions: NNCA understands the unique challenges of different industries and provides customised bookkeeping services to meet your needs.

4. Post-Audit Support: Beyond just classification, NNCA supports interpreting audit findings and implementing recommended changes to ensure ongoing financial health.

Secure your business’s financial future by partnering with NNCA. ( Accounting & Book keeping Service )

Capital and revenue expenditure examples and classifications help you comprehend the vitality of outsourcing bookkeeping. They are fundamental to maintaining accurate financial records, managing taxes, and meeting compliance requirements in the UAE. Understanding and correctly implementing these classifications minimises the risk of financial misstatements and supports long-term business growth. Partnering with NNCA, an experienced accounting firm, ensures the meticulous recording of these expenditures, reducing tax and compliance risks and promoting financial transparency.