The India-UAE Double Taxation Avoidance Agreement (DTAA) ensures that individuals and businesses aren’t taxed twice on the same income, fostering a more favourable environment for trade, investment, and economic cooperation between the two countries. As cross-border transactions increase, understanding this treaty becomes essential for smooth financial planning, particularly when considering the tax in Dubai for Indian. This agreement offers relief for Indian residents working in or earning income from the UAE, ensuring fair taxation and promoting bilateral economic relations.

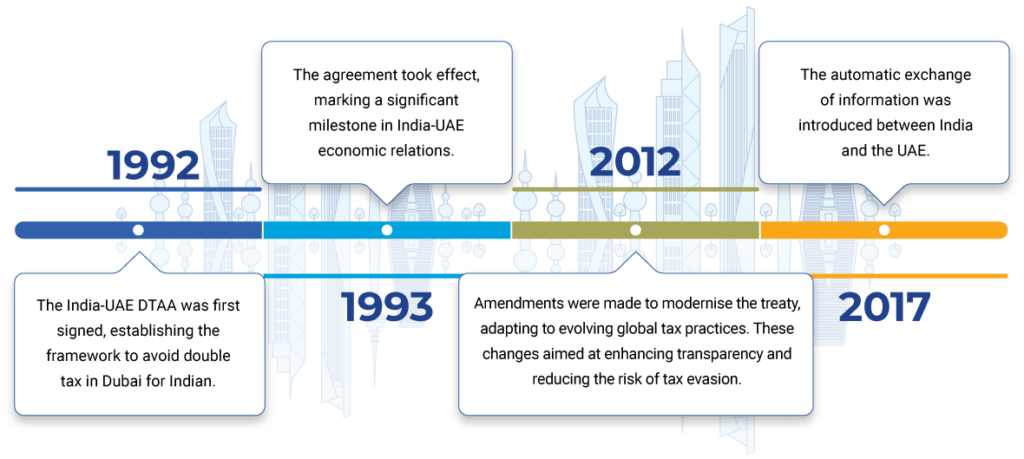

A Brief Chronological History of the India-UAE DTAA

Tax in Dubai for Indian: Understanding the Scope of Taxation

The India-UAE DTAA clearly defines the scope of taxation for different types of income. It ensures that individuals and companies are not taxed twice on the same income across borders. This clarity is essential for Indian residents to understand India’s DTAA with UAE or those who generate income from India and the UAE.

The table below summarises the taxation rules for key income categories under the DTAA:

| Type of Income | Income Earned In | Income Taxed In | Exceptions |

|---|---|---|---|

| Interest | Resident country of the recipient | Same resident country of the recipient | Taxed in the source country but capped at 5% on bank loans and 12.5% in other cases |

| Dividends | Resident country of the recipient | Same resident country of the recipient | Taxed at a rate not exceeding 10% in the country where the paying company is located |

| Royalties | Resident country of the recipient | Same resident country of the recipient | Subject to a tax rate not exceeding 10% in the country where the royalties arise |

These provisions under the India-UAE DTAA are designed to reduce the tax burden on individuals and businesses, ensuring taxpayers can manage their cross-border earnings more efficiently. The DTAA between India and UAE prevents companies and individuals from being taxed on the same income in both jurisdictions.

Key Benefits and Rates Under the India-UAE DTAA

The India-UAE DTAA offers various benefits, particularly for Indian residents working in the UAE. Understanding these benefits is critical for those affected by tax in Dubai for Indian or managing income from both countries.

Here are the key tax rates and benefits under the India-UAE DTAA:

- Dividends: Capped at a 10% tax rate, making it highly beneficial for investors and companies. This reduced rate encourages cross-border investments between India and the UAE.

- Interest: Capped at 5% on bank loans, offering significant relief for lenders and borrowers alike. Other interest income forms are taxed at a maximum of 12.5%, making it easier to manage international financial transactions.

- Royalties and Fees for Technical Services: Taxed at a maximum rate of 10%, ensuring that businesses involved in intellectual property and technical services can operate efficiently between India and the UAE.

These lower tax rates prevent the double taxation burden and help optimise cross-border financial planning. Whether it’s dividends, interest, or royalties, the DTAA ensures fairness in taxation across both jurisdictions, allowing businesses and individuals to focus on growth without worrying about excessive tax liabilities.

For more comprehensive insights into tax rates and how the India-UAE DTAA applies to different income categories, explore Corporate Tax For Foreign Companies.

Practical Implications for Individuals and Businesses

The DTAA between India and UAE simplifies tax compliance, reducing financial burdens for:

- Indian residents working in the UAE: The DTAA provides relief by ensuring that their income is taxed only once, either in India or the UAE, depending on their residency status and income type. This makes financial planning more predictable and removes the uncertainty of being taxed twice on the same income.

- Businesses with operations in both countries: The treaty eliminates the ambiguity regarding which country has the right to tax specific types of income. This clarity helps companies manage their cross-border tax obligations more effectively and avoid unexpected tax bills.

The India-UAE DTAA fosters better economic cooperation between the two countries and also removes tax barriers that might otherwise discourage investments and trade.

Role of NNCA in Simplifying Compliance on Tax in Dubai for Indian

NNCA helps businesses and individuals navigate the complexities of the India-UAE DTAA. Their team of experts ensures that businesses and individuals can fully leverage the tax benefits offered by the DTAA, while remaining compliant with the local tax laws in both countries.

Here’s how NNCA can assist:

- Tax registration and compliance: NNCA guides businesses through the entire process of tax registration, ensuring they meet all obligations under the India-UAE DTAA. This reduces the risk of penalties for non-compliance and maximizes the treaty’s benefits.

- Obtaining Tax Residency Certificates(TRC). NNCA will assist in getting the TRC to benefit from the DTAA rules, which is also needed for income from other countries.

- Penalty mitigation: With expert knowledge of tax law, NNCA can help businesses avoid common tax pitfalls, ensuring they stay on the right side of tax authorities. By identifying and correcting potential compliance issues early on, NNCA minimizes the risk of costly penalties and legal challenges.

To learn more about how NNCA can assist with tax compliance in the UAE, explore Taxes In UAE.

FAQs on the India-UAE DTAA

How does the DTAA impact Indian residents in Dubai?

– DTAA between India and UAE prevents double taxation, allowing residents to claim relief in their home country.

Does this treaty apply to passive income like interest or dividends?

– Yes, the India-UAE DTAA covers passive income, providing reduced tax rates for interest, dividends, and royalties.

What happens if I earn rental income from property in the UAE?

– Generally, rental income is taxed in the country where the property is located, ensuring that Indian residents do not face double taxation on property income earned in the UAE.

Can businesses operating in both India and the UAE benefit from the DTAA?

– Yes, the DTAA with UAE provides clear guidelines on which country has taxing rights for business profits, ensuring that companies are not taxed twice on the same income.

What are the common pitfalls that businesses should avoid under the DTAA?

– Failing to properly classify income or misunderstanding which country has taxing rights can lead to unexpected tax liabilities. Businesses should seek expert guidance to ensure they are compliant with both Indian and UAE tax laws.

Conclusion

The India-UAE Double Tax Treaty is a critical tool in fostering stronger economic cooperation between India and the UAE. By eliminating double taxation, the treaty ensures that individuals and businesses can operate across both countries without facing unfair tax burdens.

NNCA’s expertise in international taxation helps individuals and businesses understand the complexities of the DTAA between India and UAE. From registration to compliance, NNCA ensures that you fully leverage the treaty’s benefits while avoiding any compliance risks.

For more insights and guidance on tax compliance in the UAE, reach out to NNCA today