The United Arab Emirates (UAE) introduced a Corporate Tax Law effective June 1, 2023. This tax law is consequential for businesses operating in the UAE and carries implications for their profits and tax obligations. In this quick and simple guide, we will delve into the nuances of Corporate Tax registration UAE, helping businesses understand the process and requirements involved in staying compliant with this recently established regulation.

The Corporate Tax Rates:

The Corporate Tax Law introduces a 9% tax on the profits (revenue minus expenses) of all businesses generating over 375,000 AED (approximately USD 100,000). It’s important to note that businesses generating less than this sum will continue to pay a 0% tax rate.

The tax period and timeline:

The imposed Tax Period follows the Gregorian calendar year. Hence, it is set from January 1 to December 31. However, the exception applies if a specific business follows a different 12-month period for preparing its financial statements.

You are given a registration window that extends up to the filing of your first tax return. To illustrate, if your financial year ends on May 31, you have a 26-month registration period available, culminating on February 28, 2025. In the case of a financial year concluding on December 31, you benefit from a 33-month registration timeframe, stretching until September 30, 2025.

Timeline Chart:

- Financial Year Ending on May 31, 2024:

- Registration Period: January 1, 2023, to February 28, 2025.

- Financial Year Ending on December 31, 2024:

- Registration Period: March 1, 2023, to December 31, 2025.

How to Register for Corporate Tax in UAE. The Details:

Businesses operating in the UAE must undergo the Corporate Tax registration process to ensure compliance with the new tax law. The registration process began early in 2023, and businesses must adhere to the specified timelines.

The FTA provides services to facilitate the registration of specific individuals for Corporate Tax. It enables them to acquire a Corporate Tax registration UAE number and meet their tax-related obligations. You can apply for this service through the EmaraTax platform, which is accessible 24 hours a day, seven days a week, and is entirely free of charge.

Online Corporate tax Registration via EmaraTax:

The UAE Federal Tax Authority (FTA) has smoothened the registration process by offering an online platform, EmaraTax, for corporate tax registration and payment. The registration process, which you can complete online, has been initiated on the EmaraTax platform. Businesses need to leverage this digital infrastructure to ensure timely compliance. Typically, the application process takes 30 minutes and 20 business days from when the FTA receives the completed application.

However, if additional information is required, the FTA may extend the processing time. In such cases, the applicant should provide the necessary information and resubmit the application. The FTA will require 20 business days to respond to the updated application. If the application is submitted within 60 calendar days from the date of the notification from the FTA, it will be accepted.

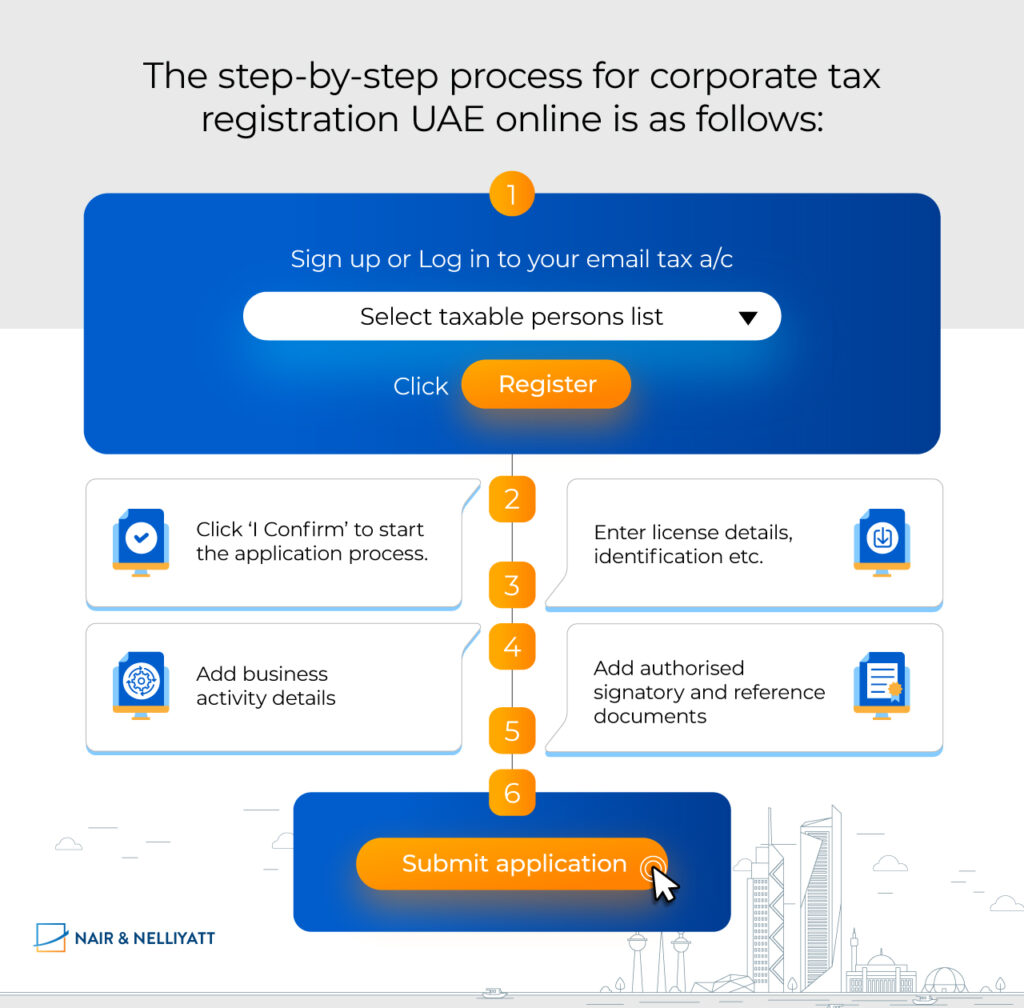

Steps of the registration process:

If the question is, “What is the registration process for corporate tax in UAE?” or “How to register for corporate tax in UAE?”, then the FTA website provides the solution. It also offers a handbook pdf explaining the process. The EmaraTax platform is a digital initiative that aims to facilitate an efficient taxation process, providing a user-friendly interface for businesses.

Step 1: Create an account on the EmaraTax portal by registering with your email ID and phone number or log in using your existing ID and password.

Step 2: Create your taxable person profile or select the relevant taxable person from the taxable person list

Step 3: Read and confirm the instructions and guidelines

Step 4: You will be given the option to start the process to register for Corporate Tax. Please select this option and complete your registration by filling in the mandatory details. You must fill in entity details, identification details, contact details, and authorised signatory, followed by review and declaration.

The step-by-step process for corporate tax registration UAE online is as follows:

Required Documents:

The specific requirements for corporate tax registration UAE vary depending on whether the business operates in the Mainland or within Free Zones / QFZP. Here’s a breakdown of the essential documents required for corporate tax registration in UAE Free Zones:

1. Passport copy of the owner/partners (must be valid).

2. Copy of the Trade License (must not be expired).

3. Lease agreement within the Free Zone.

4. Free Zone company establishment documents.

5. Contact details of concerned persons (mobile number and email).

6. Contact details of the company (full address and P.O. Box).

7. Passport copies of the managers or authorised signatories.

8. NOC from the Free Zone authorities.

9. Annual Financial Audit Report.

10. Memorandum of Association (MOA) or Power of Attorney (POA).

11. Emirates ID of the owner/partners (must be valid).

For businesses registered outside the Free Zones, the following documents are required for corporate tax registration in UAE:

1. Passport copy of the owner/partners (must be valid).

2. Copy of the Trade License (must not be expired).

3. Contact details of concerned persons (mobile number and email).

4. Contact details of the company (complete address and P.O. Box).

5. Annual Financial Audit Report.

6. Memorandum of Association (MOA) or Power of Attorney (POA).

7. Emirates ID of the owner/partners (must be valid).

Points about the documents :

- • Accepted file types are PDF and Word. The individual file size limit is 5MB.

- All documents submitted during the corporate tax registration process must be legitimate and current.

- Submitting fraudulent or outdated documents can lead to penalties and potential legal ramifications.

Key Legal words and their meanings:

The term “Natural Person” in the Corporate Tax Law means an individual.

Individuals earning income from wages, investments, commercial, industrial, or professional activities, whether directly or as sole proprietors, are also subject to the Corporate Tax Law. A Cabinet Decision will provide further insights into the criteria for natural persons falling within the scope of UAE Corporate Tax.

“Juridical person” or “Legal person” refers to an entity legally recognised under UAE laws or foreign jurisdiction regulations. This entity possesses a distinct legal identity separate from its founders, owners, and directors. In the UAE, domestic juridical persons include entities like limited liability companies, foundations, onshore trusts, public or private joint-stock companies, and other organisations that have their own legal identity according to UAE mainland laws or Free Zone regulations.

However, it’s important to note that UAE branches of domestic and foreign juridical persons are considered extensions of their parent or head office. As a result, they do not hold separate juridical status.

Understanding “Business” and “Business Activity”:

The Corporate Tax Law defines “business” as any economic activity, whether continuous or short-term, conducted by any person. It implies that a business is achieved with a profit motive and organised systematically. Crucially, a business doesn’t lose its identity as such simply because it operates at a loss.

The law further considers all activities and assets utilised by companies or juridical persons as relevant to their business. This includes both profit-generating and non-profit activities.

Exemptions and Implications:

Some entities are exempt from UAE Corporate Tax. These exemptions apply either automatically or upon application. The entities exempt from corporate tax include:

1. The UAE Federal and Emirate Governments and their related institutions.

2. Wholly Government-owned companies engaged in mandated activities.

3. Businesses involved in natural resource extraction and related non-extractive activities.

4. Public Benefit Entities.

5. Investment Funds meeting prescribed conditions.

6. Public or private pension or social security funds meeting specific criteria.

7. UAE juridical persons wholly owned and controlled by specific exempted entities.

Conclusion:

The FTA provides all relevant solutions and guides all persons to know everything about how to register for corporate tax in UAE in a streamlined manner. However, if the complex guidelines, options, terms and conditions make you hesitant, feel free to contact us, Nair and Nelliyatt; we are here to help.