In the UAE, a VAT return must be created and submitted once every tax period by each registered taxpayer. Depending on the instructions provided by the FTA on your VAT certificate, the tax term is either a month or a quarter (3 months).

In this article, we explain how to file VAT returns in simple steps.

VAT Returns User Guide

An overview of all the sales and purchases you made during a specific tax period can be found in a tax return. This covers VAT paid or collected on each transaction, as well as imports, exports, and exempt supplies. This form needs to be created using your invoices and submitted via the FTA e-portal.

The FTA portal is designed to only accept returns submitted online because there are currently no offline options for filing VAT returns using XML, EXCEL, or any other software. This suggests that the taxpayer must manually fill out the figures for Sales, Purchases, Output VAT, Input and Input VAT, etc. in the appropriate fields of the VAT return form that is available on the FTA portal.

The taxpayer must fill out and submit the “VAT 201” VAT Return form in order to complete the filing of the VAT Return. The Form VAT 201 is broadly divided into the following 7 sections:

- Taxable Person Details

- VAT Return Period

- VAT on sales and all other outputs

- VAT on expenses and all other inputs

- Net VAT Due

- Additional reporting requirements

- Declaration and Authorised Signatory

Each of these sections contains several boxes where the taxpayer must enter information to complete the submission of the VAT tax return.

How to file VAT returns in the UAE – VAT Return Form 201

The taxpayer must enter their registered username and password to access the FTA e-Services portal in order to view the VAT Return Form 201. To begin the process of filing a VAT return, choose VAT from the Navigation menu, then VAT 201- VAT Return, and finally VAT 201-New VAT Return.

The various sections of the VAT return form will open when you click VAT 201- New VAT Return as displayed in the above image. Let’s go over the steps involved in submitting a VAT tax return as well as the data that must be included in each of the parts that follow.

1. Taxable Person Details

The TRN or Tax Registration Number of the taxpayer, together with their name and address, will be recorded in the area above. This associated information will populate itself.

The TAAN (Tax Agent Approval Number) and the corresponding TAN (Tax Agency Number), as well as the name of the Tax Agent and the Tax Agency, are filled out at the top of the VAT Return in the event that a tax agent submits the VAT return on behalf of a taxpayer.

2. VAT Return Period

The information in the aforementioned area, including the Tax Year end, the VAT return period reference number, and the VAT return due date, will be filled in automatically.

For companies who cannot recover all of their input VAT and must make an annual adjustment for input tax apportionment, the tax year end is important. Only the first return after the end of the tax year is eligible for such an adjustment. The reference number for the VAT return period identifies the VAT return period that you will be finishing throughout that tax year.

3. VAT on sales and all other outputs

You must include information about taxable supplies with a standard rate at the Emirates level, taxable supplies with a zero rate, taxable supplies that are exempt, taxable supplies that are subject to the reverse charge mechanism, etc. in this section.

4. VAT on Expenses and All other Inputs

You must include the details of any purchases or expenses for which you have already paid VAT at the regular rate of 5% in this section, along with the applicable recoverable input tax.

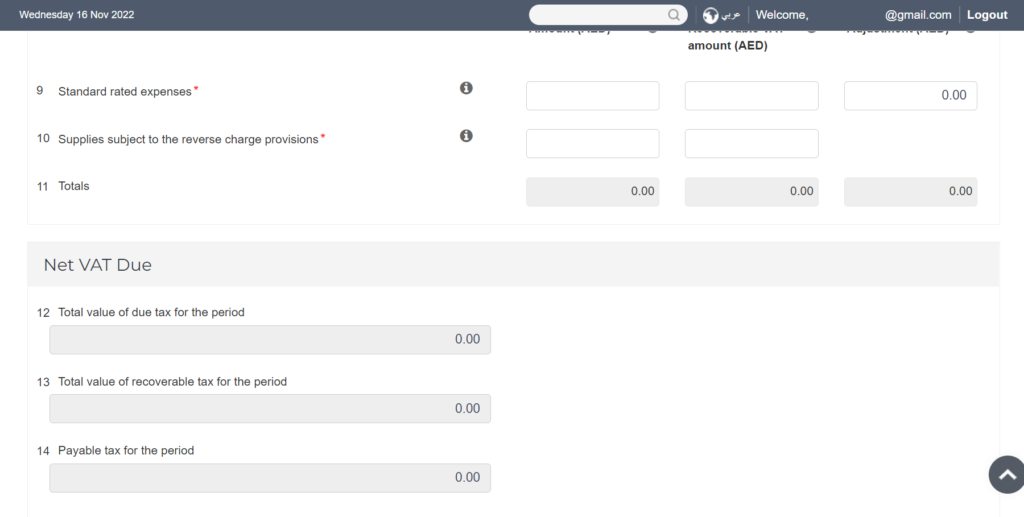

5. Net VAT Due

Your VAT payment for the period of the VAT return is indicated in this section. The total amount of production tax that is owed for the tax period is shown in box number 12: Total Value of Due Tax for the Period. Based on the data reported in Sales and all other outputs, this will be calculated.

Similar information may be found in box number 13: Total value of recoverable tax for the period, which shows the total amount of recoverable input tax for the tax period. This will be computed using the information provided in the section on VAT expenses and all other inputs.

The payable tax for the period is shown in box number 14, which is the difference between the total amount of owed taxes for the period and the total amount of recovered taxes for the period. It will neither result in Net VAT payable nor recoverable tax.

The amount of VAT that you must pay is the difference if the sum in Box 12 exceeds the amount in Box 13. You will be able to request a refund for the net amount of recoverable tax or carry it forward to the following VAT return period if the amount in Box 12 is less than the amount in Box 13.

6. Additional reporting requirements

Only companies that have utilised and applied the Profit Margin Scheme’s provisions during this time frame are subject to this section. Otherwise, you can select “No” and move on to the next part of the filing process. This is merely an extra reporting requirement that has no financial bearing on your VAT return.

7. Declaration and Authorised Signatory

To submit the VAT Return, you must fill out the part above with the information for the authorised signatory and check the box next to the declaration section. Additionally, the taxpayer has the choice to save the information as a draft and submit it later.

The taxpayer must take great care to ensure that all the information is accurate before submitting the VAT Return. Only then should the taxpayer click the submit button. A taxpayer will receive an email from the FTA verifying the submission of the VAT return form following the successful filing of the VAT Return.

Conclusion

We hope you have understood how to file VAT returns in the UAE with the help of our VAT returns user guide. The procedure of calculating VAT is tedious and time-consuming because it involves compiling all taxable exports and imports for the given period. Additionally, due to the requirement for consolidated details of sales and purchases, the UAE VAT return filing is extremely challenging for firms with little to no experience in filing the VAT. It becomes more difficult because the information also needs to feed in a specific format as per the FTA.

As one of the leading accounting firms in UAE, we can help your business quickly file a valid VAT return in a swift, accurate manner and, more importantly, help you avoid paying costly penalties that may range from AED 1,000 to 3,000 for inaccurate or incomplete VAT returns.

Reach us today at +971 43577678 or drop us an email at info@nn-ca.com. We will get back to you at the earliest.