In this era, where flexibility and adaptability have been redefined for companies, outsourcing leadership roles is a channel worth exploring. Leadership roles require specific skill sets, qualifications, and a rooted network in the field. And when it comes to CFO services, the expertise needed is critical, yet hiring someone with such skills and experience can be relatively inexpensive, especially for startups and small to mid-sized companies.

A CFO plays an integral part in strategic financial management, but most qualified CFOs command high salaries that many smaller businesses cannot justify. And, most inhouse CFOs are brimmed with their leadership duties to focus upon specific financial planning for the company.

Consequently, the popular solution is to outsource CFO services, providing companies with the financial leadership they need that is justified and equally effective. This not only provides a cost-effective solution but also relieves them of the financial burden and stress, offering a sense of reassurance in these challenging times.

The Traditional CFO Model

The traditional CFO job model involves hiring a full-time, in-house Chief Financial Officer to manage all financial aspects of a company, including budgeting, forecasting, compliance, and strategic planning. In the present corporate office setup, adaptability and cost-efficiency are paramount, and the traditional model can strain resources and limit agility.

The Rise of Outsourced CFO Services

Many companies find it more practical to hire a CFO who offers access to high-level financial expertise on a flexible, scalable, and more affordable basis. Outsourced CFO services have emerged as a strategic solution for businesses seeking financial expertise without the overhead costs of a full-time CFO. Outsourcing provides access to seasoned professionals with a wealth of experience and insights.

What is an Outsourced CFO?

An outsourced CFO offers financial management and strategic guidance to businesses on a contractual basis. These professionals typically have extensive experience in their fields, with many holding advanced degrees in finance or accounting. They have also held leadership roles across different industries and company sizes, giving them a broad perspective and a deep understanding of business operations.

Much like how a great CFO can make a big difference in managing your company’s finances, the right Internal auditor in UAE can also be a real asset for your business. Here’s some detailed information about what you can expect from an internal auditor and how they add value to your business.

Value of Outsourced CFO Services for Small to Mid-Sized Companies

For small to mid-sized companies, outsourced CFO services offer immense value by providing access to high-level financial expertise without the expense of a full-time executive. These cost-effective services allow businesses to benefit from strategic financial planning, accurate financial reporting, and efficient cash flow management. By leveraging outsourced CFOs, smaller companies can focus on their core operations, drive growth, and ensure economic stability while adapting to the dynamic business environment with greater flexibility and scalability.

Finding our Business Consultancy Services content interesting?

world-class services.

THE FIRST CONSULTATION IS FREE!

Value of Outsourced CFO Services for Global Companies with an In-House CFO

Global companies that already have an in-house CFO can also benefit significantly from outsourced CFO services. These services can supplement the in-house CFO’s efforts, handling specific projects such as mergers and acquisitions, international expansion, and regulatory compliance.

This collaboration enhances the company’s financial management capabilities, optimizes performance, and provides a comprehensive approach to tackling complex financial challenges on a global scale. Importantly, outsourcing CFO services does not mean replacing the in-house CFO, but rather, it enhances their capabilities and allows them to focus on strategic decision-making.

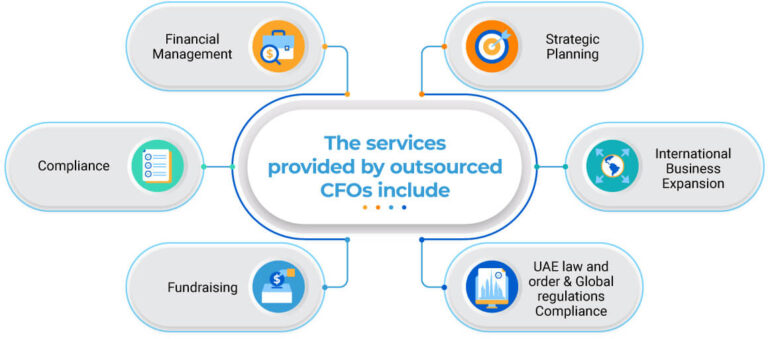

The Strategic Role of Outsourced CFO Services in Finance

Outsourced Accounting

Hiring a CFO and outsourcing CFO services often include complete accounting solutions. These services handle everything from bookkeeping to financial reporting, making financial processes more straightforward and accurate. This ensures that businesses stay compliant and transparent. By outsourcing accounting, companies can focus on their main activities while keeping their finances strong.

Payroll outsourcing is also one way of ensuring that you focus on the core of your business while an external team takes care of the complexities associated with calculating and processing employee salaries, taxes, and other deductions. Here’s a detailed blog about how to outsource payroll and get the help of the right professionals to keep the process seamless and precise.

Outsourced Finance

Beyond accounting, outsourced CFO services cover a more comprehensive range of financial tasks, including financial planning, budgeting, forecasting, and risk management. These experts collaborate closely with internal teams, providing strategic advice and insights to enhance economic performance and minimize potential risks.

Working together, they help businesses make informed decisions and achieve their financial goals more effectively, empowering them to shape a brighter financial future. This comprehensive coverage of financial tasks ensures businesses feel secure about their financial operations, knowing that every aspect is being handled with expertise and care.

When Do You Need Outsourced CFO Services?

1. Growth Phase: When your business is expanding rapidly, an outsourced CFO can help manage increased financial complexity and ensure sustainable growth.

2. Financial Troubles: If your business faces cash flow issues, declining profitability, or financial instability, a CFO can provide the strategic guidance needed to turn things around.

3. Mergers and Acquisitions: During M&A activities, a CFO can assist with due diligence, valuation, integration, and financial planning.

4. Strategic Planning: When setting long-term goals and strategies, a CFO’s insights are crucial for financial forecasting and resource allocation.

5. Regulatory Compliance: The complex regulatory environment in the UAE can entangle a careless business with penalties. An outsourced CFO ensures your company remains compliant with local laws and regulations, instilling a sense of security and confidence in your business operations. They stay updated with the latest regulatory changes, implement necessary changes in your financial processes, and ensure that your company’s financial practices are in line with the law.

Critical Functions of Outsourced CFOs

1. Strategic Financial Guidance:

- Outsourced CFOs act as strategic advisors, aiding businesses in making informed financial decisions to drive growth and profitability.

- They analyse financial data, identify trends, and recommend strategies to achieve financial objectives.

2. Financial Planning and Analysis:

- They develop comprehensive financial plans, forecast future performance, and assess the business’s financial health.

- These analyses guide decision-making and optimize financial strategies.

3. Budgeting:

- Assist in creating budgets aligned with business goals and priorities.

- Effective budgeting ensures proper resource allocation and meeting financial targets.

4. Cash Flow Management:

- Optimize cash flow to maintain liquidity for day-to-day operations.

- Analyse cash flow patterns and implement strategies to enhance working capital.

5. Financial Reporting:

- Prepare timely and accurate financial reports, which are crucial for decision-making and compliance.

- These include income statements, balance sheets, and cash flow statements.

The role of a CFO is multifaceted, encompassing a wide range of responsibilities:

1. Financial Planning and Analysis: Developing financial strategies, forecasting, and budgeting to support business objectives.

2. Cash Flow Management: Ensuring the business has adequate liquidity to meet its obligations and invest in growth opportunities.

3. Risk Management involves identifying and mitigating financial risks to protect the company’s assets and ensure long-term viability.

4. Financial Reporting: Preparing accurate and timely financial statements to inform stakeholders and comply with regulatory requirements.

5. Strategic Advisory: Providing insights and recommendations to the executive team on financial matters and business strategies.

6. Investor Relations: Managing relationships with investors, banks, and other financial stakeholders.

Why Choose NNCA CFO Services?

At NNCA, we understand that a company’s CFO often needs more time to consider the financial and accounting issues crucial for the business’s success. Their day is consumed by daily operational tasks, leaving little room for strategic financial planning. Yet, paying attention to these financial components can help a company’s growth prospects. This is where our CFO services step in to make a real difference.

Our Chief Financial Officers manage your company’s significant financial aspects, including planning, documenting, reporting financial transactions and mitigating business risks.

We outsource CFO services to startups and small and mid-sized companies that need leadership roles. If you are gearing up for substantial organizational transformation, our CFO services in Dubai and the UAE should be a top consideration. We offer fully optimized and personalized solutions tailored to your unique needs.

Choosing NNCA CFO services can add substantial value to your company. Our services help develop your company more swiftly, improve overall productivity and profitability, enhance cash flow, and provide crucial financial guidance to CEOs. We support short-term and long-term financial planning and budgeting and facilitate mergers and acquisitions. Let NNCA’s CFO services be the strategic financial partner that drives your business towards sustainable success.

Contact NNCA today to learn more about our outsourced CFO services and how we can help your business thrive. Also, explore our internal auditor services in the UAE and business setup consulting services to support your business journey further.

Outsourcing your CFO services to NNCA is a strategic move that can drive your business toward better financial health and long-term success. Don’t wait – take the first step today!