Understanding VAT in the UAE

The UAE implemented VAT to diversify its economy and reduce reliance on oil revenues. Understanding VAT implications is crucial for businesses to comply with regulations and optimise tax efficiency. Among the critical distinctions in UAE VAT law are zero-rated supplies in the UAE and exempt supplies in UAE.

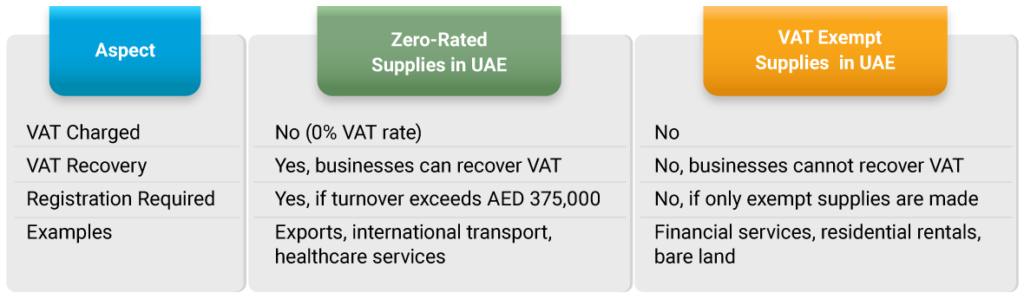

While zero-rated and exempt supplies may seem similar, they have distinct impacts on businesses and their VAT obligations, especially concerning the export of services UAE VAT and transactions classified as out-of-scope VAT UAE.

For more insights on VAT processes, check out our [VAT Return User Guide]

What are VAT-exemption in the UAE?

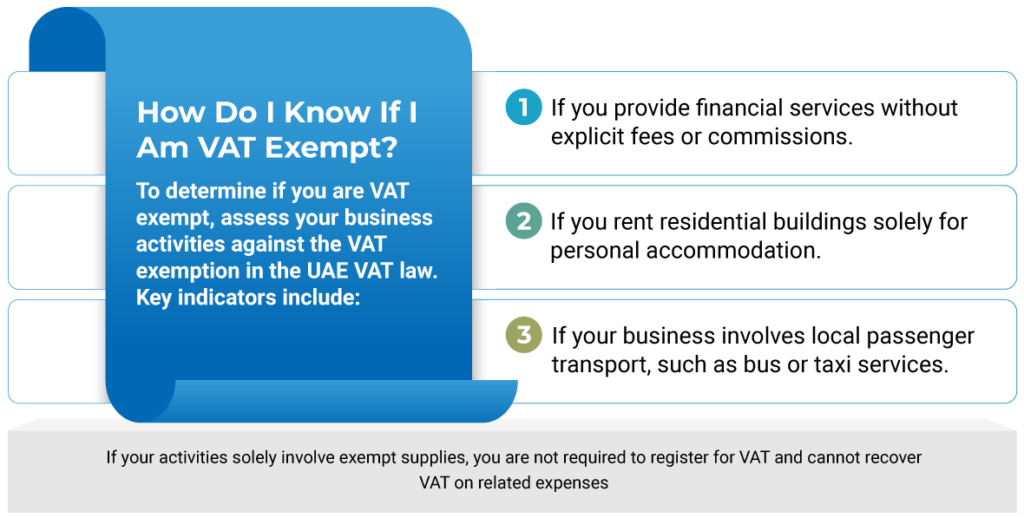

VAT Exemption in UAE refers to supplies of goods or services not subject to VAT. Suppliers do not charge VAT on these supplies, and they cannot recover any VAT paid on expenses related to making them.

Key Insights:

No VAT Charged: Suppliers of exempt goods and services do not charge VAT to customers’ prices.

No VAT Recovery: Businesses making exempt supplies cannot reclaim VAT on their purchases or business expenses related to those supplies.

Strict Exemption Criteria: Exemptions are strictly applied and outlined in specific articles of the VAT law, making it essential for businesses to know whether they qualify.

Common Examples of VAT-Exemption in the UAE:

Financial Services: Includes life insurance and reinsurance that are not conducted for an explicit fee or commission.

Residential Buildings: Rentals of residential buildings for personal accommodation, excluding those specifically zero-rated.

Bare Land: Unimproved land that has no construction.

Local Passenger Transport: Public transport services, such as taxis and buses, are provided within the UAE.

Registration Requirements for VAT- Exemption in UAE

If a business only makes exempt supplies, it does not need to register for VAT. Consequently, it cannot recover VAT on its business purchases. For example, a company renting residential properties does not charge VAT and is not entitled to recover VAT on related costs.

What Are Zero-Rated Supplies in UAE?

Zero-rated supplies in the UAE are taxable, but the VAT rate is 0%. This means that businesses charge their customers a 0% VAT rate, and significantly, they can recover the VAT on their expenses related to making these supplies.

Critical Characteristics of Zero-Rated Supplies in UAE:

VAT Charged at 0%: Goods and services are still taxable, but VAT is not added to the price charged to customers.

Full VAT Recovery: Businesses can reclaim VAT paid on purchases and expenses directly associated with making zero-rated supplies.

Encouragement for Specific Sectors: Zero-rating is often applied to promote specific sectors like exports and essential services.

Common Examples of Zero-Rated Supplies in the UAE:

Exports of Goods and Services: Exporting businesses charge a 0% VAT rate on international sales.

International Transport: Includes transport of goods and passengers by air, sea, or land across international borders.

Specific Means of Transport: Trains, trams, vessels, and aeroplanes designated for specific uses such as commercial or rescue services.

First Sale/Rent of Residential Buildings: Only the initial transaction is zero-rated supplies in UAE, benefiting first-time property buyers.

Healthcare Services: Includes specific healthcare-related goods and services that are essential and accessible.

Educational Services: These include certain educational services and related goods, making education more affordable.

Registration Requirements for Zero-Rated Supplies in UAE:

If a business makes zero-rated supplies, it must register for VAT if its taxable turnover exceeds AED 375,000 annually or is expected to do so within the next 30 days. However, businesses can request an exemption from registration if they only make zero-rated and no standard-rated supplies.

What is the difference between zero-rated supplies in the UAE and VAT-exemption in the UAE?

Understanding the distinction between zero-rated and VAT- exempt supplies is crucial as it impacts VAT recovery and compliance obligations.

Is Export Zero-Rated or Exempt in UAE?

Export of Services UAE VAT:

Exports of goods and services are classified as zero-rated supplies in the UAE. This classification allows exporters to charge a 0% VAT rate while recovering VAT on inputs related to their export activities, which helps maintain competitiveness in international markets.

What Is Out of the Scope of VAT?

Out of Scope VAT UAE:

Certain transactions are classified as “out of scope,” meaning they fall outside the VAT legislation. Such transactions do not involve the UAE and include:

Sales of Goods or Services Outside UAE: Transactions occur outside the UAE’s jurisdiction.

Transfers Between VAT Group Members: Internal transfers within the same VAT group are outside the VAT scope.

Certain Government Services: Specific government services not covered by the VAT legislation.

These activities neither incur VAT nor require reporting in VAT returns.

Key Takeaways for Businesses

- Identify Your Supply Type: Knowing whether your supplies are zero-rated, exempt, or out-of-scope VAT in UAE determines your VAT obligations and potential recovery.

- Maximise VAT Recovery: If your supplies are zero-rated supplies in UAE, ensure you claim VAT on related expenses to improve cash flow.

- Compliance Matters: Understanding your registration requirements based on supply type will keep your business compliant and avoid penalties.

Need assistance with VAT registration?

Explore our VAT Registration and Consultancy Services for expert guidance tailored to your business needs.

Unique Features of NNCA VAT Services

Expert Guidance: Receive advice on VAT implications specific to your business sector.

Comprehensive Support: From VAT registration to filing returns and compliance checks, NNCA ensures full support through the VAT journey.

Recovery Maximisation: Strategies to optimise VAT recovery for businesses, especially those involved in zero-rated supplies in the UAE and VAT exemptions in UAE.