As of 2024, property prices in the UAE have steadily increased. Dubai, in particular, has seen a surge in villa prices due to high demand, with some areas experiencing double-digit growth over the past year. Multiple other challenges exist, including value-added tax (VAT) on construction-related expenses.

However, understanding the VAT refund scheme will save you from the troubles of expensive VAT and may help you avoid overshooting your budget.

What is the Updated VAT Refund Scheme for UAE Nationals' new Building Residences in Dubai?

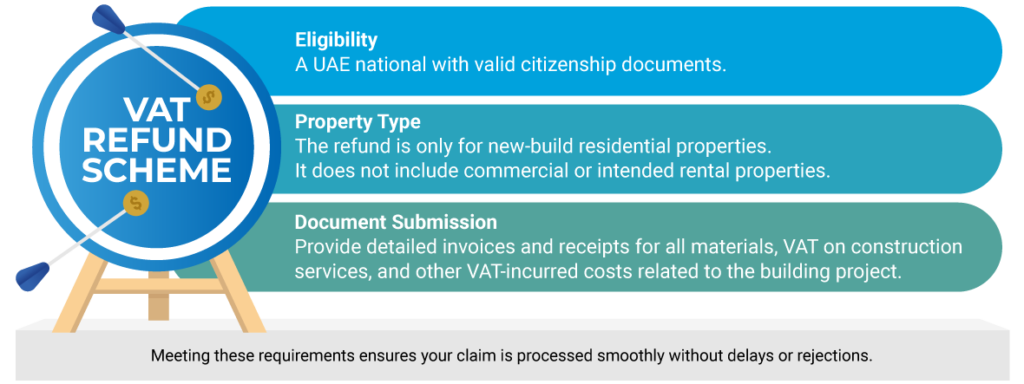

The UAE’s VAT refund scheme is only for UAE nationals’ new building residences. It allows them to reclaim VAT paid on specific construction-related costs. The government aims to ease the financial burden on citizens by offering refunds for the VAT incurred during the construction phase of a residential property.

Requirements to Qualify for the VAT Tax Refund Dubai Scheme:

When is the deadline for submitting the tax refund Dubai Claim?

Deadline: Must be submitted within 12 months of the building’s completion date.

The completion date will either be the date the local authority issues the completion certificate or the date the residence is first occupied, whichever is earliest.

Missing this deadline can result in losing the refund opportunity, making timely submissions crucial.

Eligible Expenses for VAT Refund on New Building

The VAT on newly built residential properties covers various expenses directly linked to the construction process. Eligible expenses include:

- Construction Services: building work, electrical installation, and plumbing.

- Materials: cement, steel, and other construction inputs.

- Professional Services: design and engineering services, architectural consulting

It’s important to note that luxury items like furniture and decorative landscaping do not qualify for the ‘VAT tax refund Dubai and UAE’ scheme.

Implications if the Property is Used for Commercial Purposes

If the property, initially intended as a personal residence, is later used for commercial activities, such as renting or conducting business, the VAT refund may need to be repaid. Property usage is governed by ‘ VAT on newly built commercial property rules’, which differ from residential property VAT regulations.

Before converting any property to commercial use, consult a tax advisor to avoid unexpected liabilities. Contact us now for help.

Do you plan to use your new residence as a commercial property?

Understanding VAT on Construction Services and Commercial Properties is crucial.

VAT rules vary significantly depending on whether the property is residential or commercial, influencing the management of expenses and reclaims.

To know more, read our guide on VAT on commercial property rent in UAE

How can NNCA Help You with VAT Tax Refund Dubai?

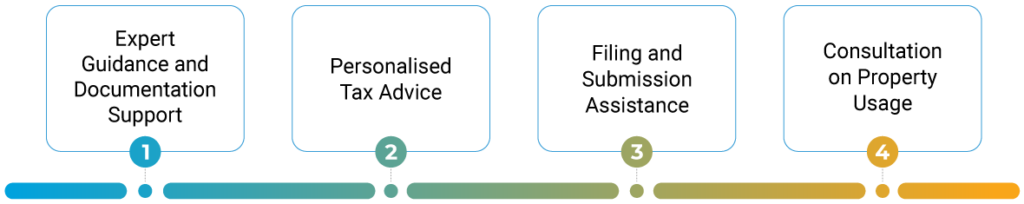

The VAT refund process on new buildings is complex and time-consuming, with its multiple detailed documentation and ever-evolving regulations. NNCA offers specialised services to streamline this process:

Are you curious about filing the VAT return?

We urge you to read these to understand the filing process better.

Visit our detailed guides on VAT return user guide : VAT return user guide

To know more about registration, read: VAT Registration and Consultancy Services

Top six FAQs: VAT Refund for UAE Nationals Building New Residences in 2024

1. What is the latest VAT refund scheme update for UAE nationals building new residences in 2024?

The updated VAT refund scheme for 2024 supports UAE nationals who build new residences by allowing them to reclaim VAT paid on specific construction-related expenses. The critical updates involve streamlined documentation requirements and digital submission processes to facilitate faster approvals.

2. Can I claim a VAT tax refund in Dubai on construction services used in building my home in 2024?

Yes, you can claim VAT on construction services such as building work, electrical installation, and plumbing, provided these services are directly related to constructing your new residence. It is essential to keep detailed invoices and proof of VAT payments for a successful refund claim.

3. What documents are required to apply for a VAT refund on newly built residential properties?

In 2024, the required documents include proof of UAE citizenship, a completion certificate from the relevant authority, detailed invoices, and receipts showing VAT payments on eligible materials and services. Digital submissions are encouraged to expedite the process.

4. Are there any changes to the deadline for submitting VAT refund claims in 2024?

No, the deadline remains the same: VAT refund claims must be submitted within 12 months from the new build’s completion date. The completion date is considered the earlier of the issuance of the completion certificate or the date of first occupancy.

5. Can I claim a VAT refund if my property converts to commercial in future?

No, if the property is used for commercial purposes such as renting or business operations after claiming a VAT refund, you may be required to repay the refunded VAT. It is crucial to consult with a tax advisor before making any changes to the property’s use. To know about selling an already converted property or selling a newly built commercial property, read our blog: vat on sale of commercial property

6. How can NNCA assist me with my VAT refund application in 2024?

NNCA provides expert guidance on compiling the necessary documentation, personalised tax advice, and assistance with the submission process. Our services’ design ensures that your VAT refund application is accurate, complete, and submitted on time, minimising the risk of delays or rejections.