Understanding the UAE’s Corporate Tax Law

Corporate tax in the UAE became effective on June 1, 2023. It is governed by Federal Decree-Law No. 47 of 2022, as amended by Federal Decree-Law No. 60 of 2023, and applies to locally incorporated businesses and foreign entities effectively managed from the UAE. The tax rate is set at 9% on annual profits exceeding AED 375,000, while natural persons (individuals) with annual business turnovers exceeding AED 1 million are also subject to corporate tax.

Critical Exemptions and Special Cases

Government entities and government-controlled entities are exempt.

Qualifying Free Zone Persons can enjoy a 0% rate on qualifying income.

The UAE is also considering a 15% Global Minimum Tax on multinational enterprises with annual revenues exceeding 750 million euros.

For more details on the registration process, read more – Corporate Tax registration UAE

Who is Liable to Pay Corporate Tax?

The corporate tax law applies to a broad spectrum of entities, including:

· Companies incorporated in the UAE

· Foreign entities with a permanent establishment in the UAE

· Natural persons with business activities exceeding AED 1 million in turnover

If you’re still unsure, learn about Corporate Tax Registration in the UAE

Registration for Corporate Tax in UAE

Businesses subject to corporate tax must register according to the Federal Tax Authority (FTA) timelines. According to FTA Decision No. 3 of 2024, registration is based on the month the business license was issued. Companies with newly issued licenses must register within three months from their license date to avoid fines.

Some corporate tax relief is available for startups and SMBs; details are available at – Small Business Corporate Tax Relief

Violations and Corporate Tax Penalties

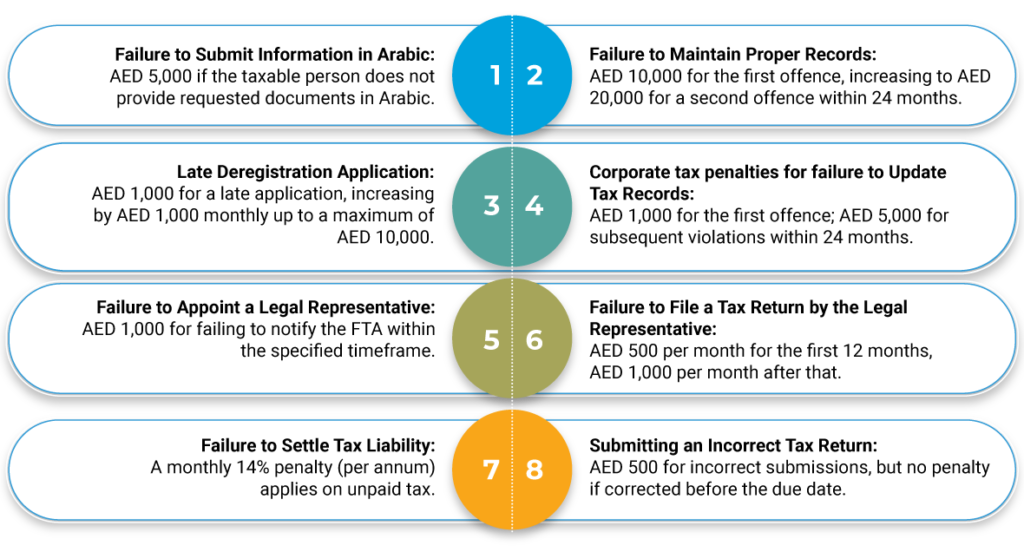

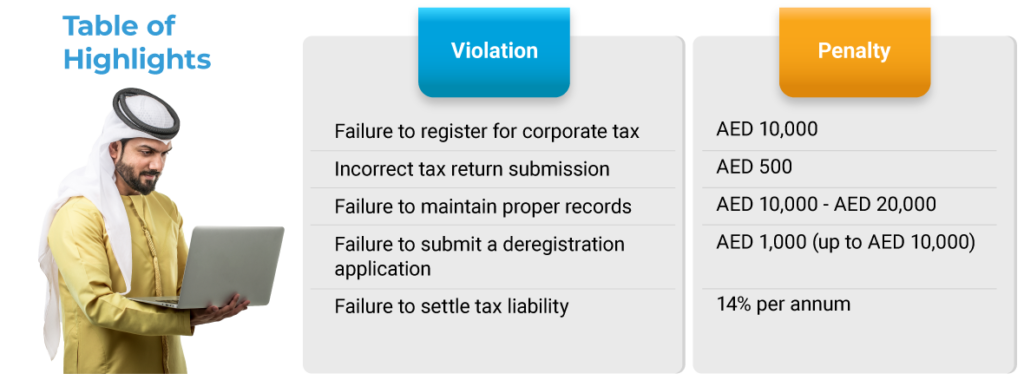

Corporate Tax Penalties for noncompliance with the UAE’s corporate tax law can be severe, covering many offences. Below is a summary based on Cabinet Decision No. 75 of 2023 and Cabinet Decision No. 10 of 2024:

These corporate tax penalties underscore the importance of adherence to tax regulations.

How FTA Enforces Compliance:

The Federal Tax Authority (FTA) takes a strict approach to compliance. Failure to adhere to corporate tax law or paying late taxes incurs additional penalties, emphasising the need for accurate recordkeeping and timely filings.

For more insights into the specific violations and penalties, visit – Tax Penalties in UAE

The Importance of Compliance with Corporate Tax Law

Compliance is not just about avoiding corporate tax penalties; it’s about maintaining your company’s reputation. Adhering to the corporate tax law demonstrates that a business operates ethically, understands regulatory requirements, and contributes to the UAE’s economic objectives.

Quick Tips for Compliance:

· Keep detailed financial records.

· Register for corporate tax on time.

· Seek professional advice to ensure all aspects of compliance are covered.

To explore the broader tax system, visit [Taxes in UAE]

FTA Fines and Penalties

Understanding the range of FTA fines and penalties is crucial to avoid hefty financial repercussions. These fines serve as a deterrent against violations of the tax system:

Failure to maintain records results in fines ranging from AED 10,000 to AED 50,000.

Incorrect submissions can lead to penalties based on a percentage of the unpaid tax.

For a comprehensive guide on these fines, consult us

Protect your business from fines by getting expert guidance on – Corporate Tax registration UAE

Role of NNCA in Supporting Businesses

NNCA offers expert support to businesses navigating the complexities of the UAE’s corporate tax system. Services provided include:

- Tax Registration Assistance: Guiding you through the registration process.

- Compliance Audits: Ensuring your business meets all corporate tax requirements.

- Corporate Tax Penalties Mitigation: Helping avoid common pitfalls that could lead to fines.

NNCA’s expertise can help you maintain compliance and avoid costly corporate tax penalties.

Conclusion

The introduction of corporate tax in the UAE represents a significant step in aligning with international standards and diversifying the nation’s revenue sources. Compliance is essential for avoiding corporate tax penalties and contributing positively to the UAE’s economic vision. Corporate tax penalties outlined in Cabinet Decision No. 75 of 2023 and the FTA’s stringent enforcement measures emphasise the importance of adherence to tax laws. By staying informed, maintaining accurate records, and seeking professional guidance, businesses can navigate the UAE’s corporate tax landscape effectively.