Introducing the Commercial Companies Federal Law, No.32 of 2021, has shifted the air in the United Arab Emirates (UAE) business world. The law mandates the audit requirements in the UAE, ensuring that businesses operating in mainland UAE follow strict financial transparency and compliance guidelines. The most notable change is the statutory audit requirement for mainland companies. For Companies, it is crucial to delve into the specifics of these audit obligations. This read will bring clarity on critical aspects of compliance.

What is a Statutory Audit in Dubai?

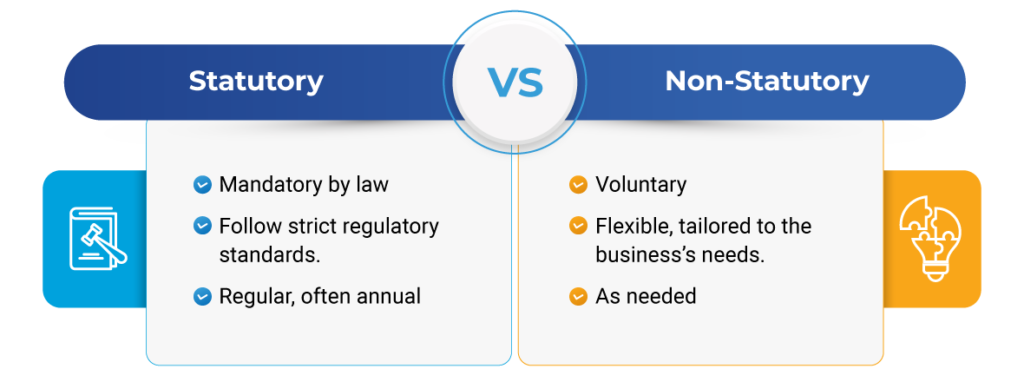

A statutory audit means a legally required audit. It is an audit or examination of a company’s financial statements and records. A statutory verifies a company’s financial ethics and compliance with UAE financial regulations.

Audit requirements in UAE ensure businesses maintain transparent financial operations and adhere to local laws, such as the Commercial Companies Federal Law. Companies in mainland UAE must undergo a statutory audit annually to validate the authenticity of their financial reports.

Statutory audits are critical because they serve multiple functions, such as:

- Ensuring accountability,

- Detecting financial discrepancies,

- Fostering investor confidence.

An external Auditor conducts these audits, evaluates the company’s financial position, and provides an independent opinion.

Learn more about Internal Audit Services, ensuring transparency and financial integrity for your business.

Functions of Statutory Audit in Dubai

The statutory audit serves several critical functions for businesses in Dubai, particularly in light of the audit requirements in the UAE:

In the UAE, these functions are beneficial for business growth and necessary for legal compliance, especially given the increasing importance of tax regulations in the region.

Learn more about the benefits of statutory audits and how they can safeguard your business from financial discrepancies.

Is Statutory Audit Requirements in the UAE compulsory?

Yes, statutory audits are compulsory for companies operating in mainland UAE.

The Commercial Companies Federal Law, No.32 of 2021, mandates that all companies in the mainland undergo an annual statutory audit. This requirement intends to foster a culture of financial accountability and transparency and ensure businesses adhere to internationally recognised financial standards.

However, businesses operating in Free Zones may have varied auditing requirements in UAE.

While some free zones do not require audits, others, like Free Zone Companies (FZCOs) and Free Zone Establishments (FZEs), may still be obligated to submit audited financial statements. Additionally, Authorities may ask free zone companies to provide audit reports for immigration purposes.

Following UAE tax regulations is Crucial! Know by exploring – Corporate Tax Registration in UAE

Is Audit Mandatory for All Companies in Dubai?

Auditing is mandatory for all companies in mainland Dubai as per the statutory audit requirement in UAE:

- Mainland companies are required to undergo an annual statutory audit, regardless of their size or industry.

- The law ensures that all businesses maintain transparent and accurate financial records, promoting trust and accountability within the business community.

- Not all UAE free zone companies are subject to mandatory audits.

- However, certain free zones have introduced auditing obligations for specific entities.

Even in cases where a statutory audit is not required, companies should consider the benefits of conducting regular audits to ensure financial accuracy and build trust with stakeholders.

Is Audit Mandatory in the UAE for Corporate Tax?

With the introduction of the corporate tax regime in the UAE, ensuring compliance through accurate financial records has become even more critical. Although corporate tax laws are relatively new, businesses subject to corporate tax must submit audited financial statements.

By undergoing statutory audits, companies can avoid penalties related to corporate tax misreporting and ensure they meet the corporate tax requirements in the UAE.

For more corporate tax and compliance information, visit – Corporate Tax for Foreign Companies

Statutory Audit Requirements in Dubai

Under the Commercial Companies Federal Law, No.32 of 2021, the following statutory audit requirements apply to companies operating in Dubai’s mainland:

1. Annual Audit: Companies must submit to an annual statutory audit by an independent external auditor. This audit examines financial statements to ensure they are accurate and free from misrepresentation.

2. Retention of Financial Records: Mainland UAE companies must retain financial records for at least five years. This requirement allows businesses to provide evidence of compliance if requested by authorities.

3. Audit Report Submission: Companies must submit audited financial statements must be submitted to relevant regulatory bodies.

These audit requirements in the UAE promote financial integrity and ensure that businesses operate within the legal framework established by the UAE government.

NNCA’s Role and Eligibility

NNCA plays a vital role in helping businesses meet their statutory audit obligations. With extensive experience in the UAE’s regulations, NNCA provides comprehensive audit services that ensure companies comply with local laws while maintaining accurate financial records.

Collaborative Approach

At NNCA, we view audits as a partnership. Our goal is to help your business identify opportunities for improvement and ensure compliance so you can grow confidently. We work closely with you every step of the way.

Minimizing Disruption

We understand that your time is valuable. NNCA's expert auditors use streamlined processes to ensure your audit is completed efficiently, with minimal impact on your team, so you can focus on running your business.

Transparency and Confidentiality

Your trust is our top priority. NNCA follows strict confidentiality standards. We handle your business information with the utmost care and discretion. You can count on us for a transparent, unbiased audit process.

Industry Experience and Expertise

With years of experience across multiple industries, NNCA brings deep expertise and an understanding of the regulatory landscape. We help your business meet all compliance requirements, reducing risks and enhancing your credibility with stakeholders.

Highlight Long-Term Benefits

A thorough audit today protects your business tomorrow. By ensuring compliance and financial transparency, NNCA helps you build trust with investors, reduce risk, and stay ahead of regulatory changes.

Offer Post-Audit Support

We don't just deliver an audit report and walk away. At NNCA, we provide actionable recommendations and post-audit support to help you strengthen your financial health and ensure compliance moving forward.

Eligibility for NNCA's Services

NNCA provides annual statutory audit services to all types of businesses operating in the UAE, from small enterprises to large corporations. Whether your business is subject to mandatory auditing or you seek voluntary audit services to ensure financial accuracy, NNCA has the expertise to guide you through the process.

Finding our Internal Audit content interesting?

world-class services.

THE FIRST CONSULTATION IS FREE!

The Commercial Companies Federal Law, No.32 of 2021, has established clear guidelines for statutory audit requirements in the UAE, making it compulsory for companies in mainland Dubai to undergo annual audits. These audits are crucial for ensuring financial transparency, compliance with regulations, and the overall integrity of business operations. We advise Companies in the UAE to embrace statutory audits as part of their broader business strategy. Audits are a discipline that complies with the law, fosters trust with stakeholders, and safeguards their financial future.